Blog

Where small business owners, entrepreneurs, and franchise owners come to learn how Reputation Marketing can propel their business growth.

-3.png)

How Efficient Field Teams Turn Great Service into 5-Star Reviews (and Repeat Customers)

4 min readwatch

How to Get More Reviews for Your Drywalling Business (Without Adding to Your Workload)

3 min readwatch

How to Get Repeat Business for Your Snow Removal Services (Without Chasing Your Customers)

6 min readwatch

4 Reasons Why You Shouldn’t Fear Negative Reviews (And How to Use Them to Your Advantage)

4 min readwatch

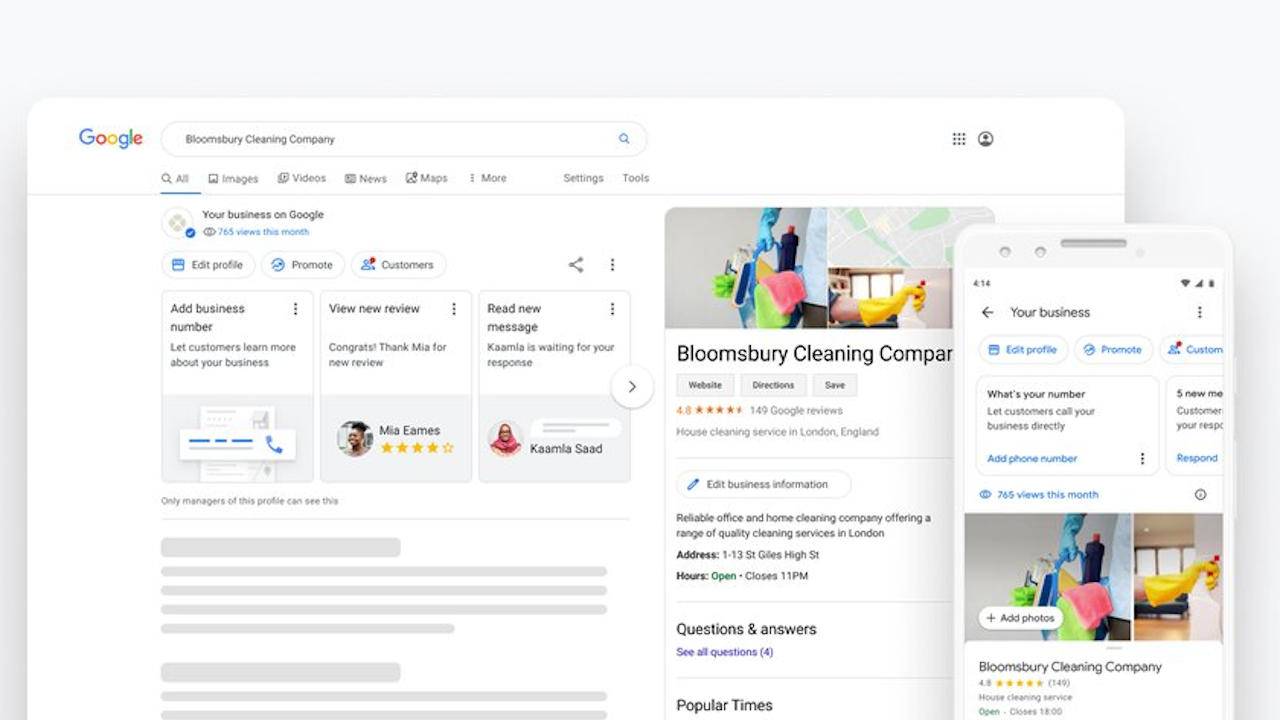

Everything Your Business Needs to Know About Getting Set Up with a Google Business Profile

3 min readwatch

How to Start a Carpet Cleaning Business (and Build a 5-Star Reputation From Day One)

4 min readwatch

How to Get More Reviews for Your Carpet Cleaning Business (Without Bugging Your Customers)

5 min readwatch

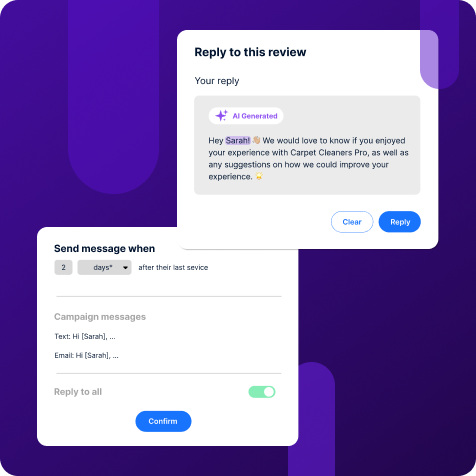

How to Get Repeat Customers for Your Carpet Cleaning Business (Without Having to Chase Them)

4 min readwatch

How to Get More Leads for Your Lawn Care Business (Without Spending a Fortune on Ads)

5 min readwatch

The Top 5 Things to Delegate or Automate in Your Business (So You Can Grow Without Burning Out)

3 min readwatch

How to Get More Reviews For Your Pressure Washing Business

4 min readwatch

Why Your Online Reputation is the Best Marketing Tool for Your Electrical Business, and How to Protect It!

6 min readwatch

The Ultimate Guide to Marketing Your Landscaping Business (and Keeping Your Schedule Full)

4 min readwatch

From Local Service to Market Leader: Proven Strategies to Grow Your Pest Control Business

5 min readwatch

From Frustration to Innovation: Turning Business Challenges into Game-Changing Solutions

3 min readwatch

Online Reputation Management for HVAC Businesses: How to Build Trust and Win More Customers

4 min readwatch

14 Lucrative Landscape Marketing Ideas to Up New Lawn Care Clients and Win More Sales

8 min readwatch

-min.png)

How Good Guy Plumbing Rapidly Scaled Business Growth Using NiceJob with Housecall Pro

2 min readwatch

Mindbody and NiceJob Partner to Help Health and Wellness Companies Succeed in their Local Markets

2 min readwatch

6 Franchise Advantages and Disadvantages That Franchisees and Franchisors Need to Know

6 min readwatch

The Easiest, Most Overlooked Way to Bring New Customers To Your Restaurant: A Case Study

3 min readwatch

How to Grow a Small Electrical Business and Win More Sales

5 min readwatch

Salon Marketing Strategies to Grow Your Business

7 min readwatch

Wider Flow of Information Allows NiceJob Customers to Trigger More Automatic Actions

2 min readwatch

.png)

6 misconceptions about your Convert website

6 min readwatch

.jpg)

.jpg)

-1.jpg)

.png)

.png)

.jpg)

-3.jpg)

.jpg)

.jpg)

.png)

.jpg)

-2.jpg)

.jpg)

.jpg)

.jpg)

-1.webp)

.jpg)

%20(1).jpg)

.jpg)

%20(1)-1.jpg)

%20(1).jpg)

.jpg)

%20(1).jpg)

%20(1).jpg)

.jpg)

.jpg)

-1.png)

.jpg)

.jpg)

.jpg)

.jpg)

%20(1).jpg)

.jpg)

.png)

.png)

.jpg)

%20(1).png)

.png)

%20(1).jpg)

.png)

%20(1).jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)